non filing of income tax return consequences

Whether you owe money to the federal government or you are entitled to a refund of taxes you paid there are consequences for failing to file an income tax return. Loss of Interest and delay in the.

How To Respond To Non Filing Of Income Tax Return Notice

The last date to file returns for the.

. Here are 5 of them. Income between 5 lakhs and 10 lakhs 20 tax. Understanding Income tax with these.

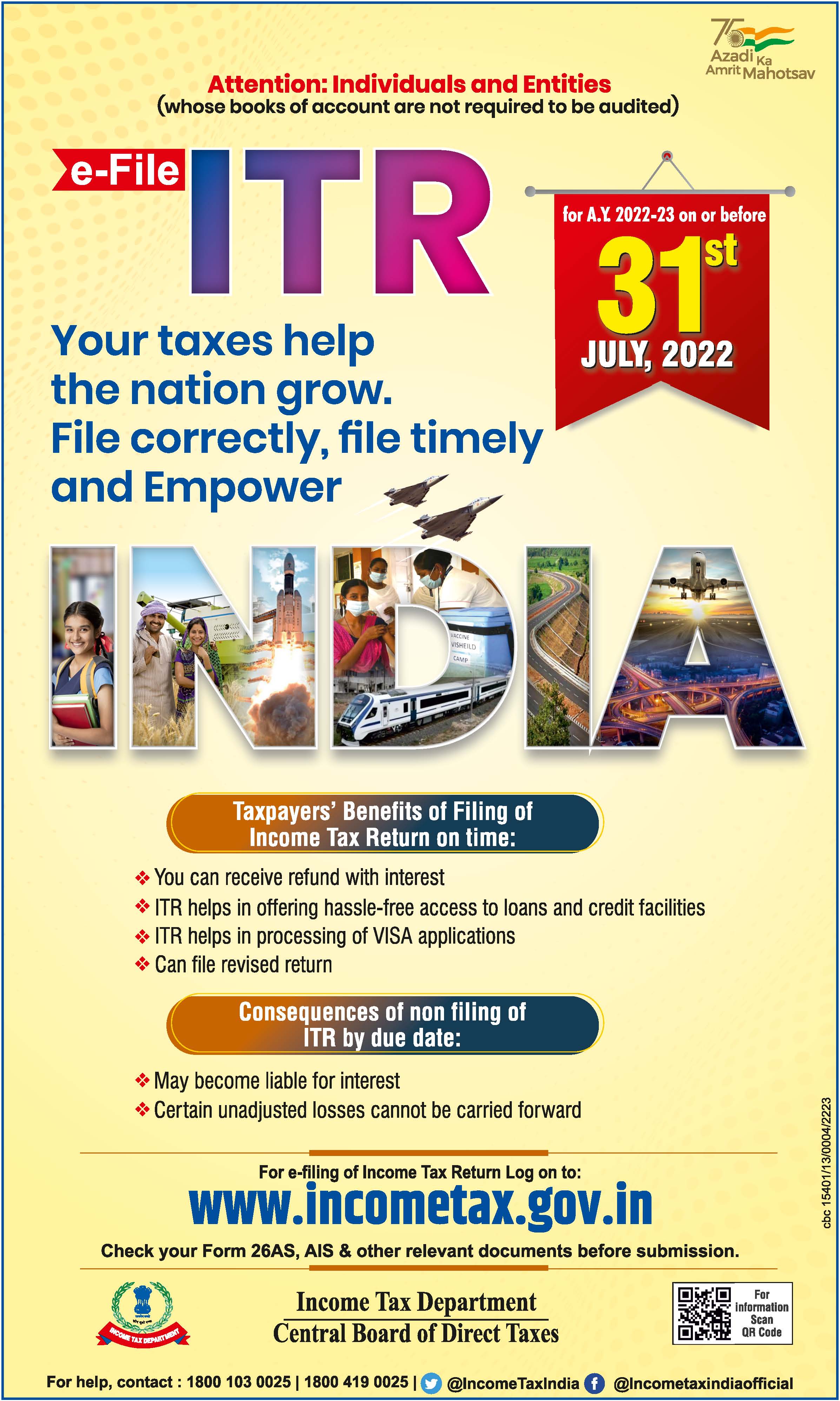

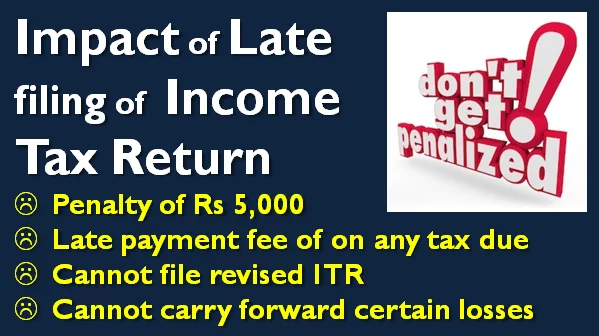

You would be required to pay a. Consequences of Non-Filing of the Income Tax Return If a person fails to furnish return before the end of the relevant assessment year the assessing officer may levy a penalty. Ad Prep File Your Own Taxes with Fast User-Friendly Software 100 Free.

The failure to file before concerned due date leads to face many consequences by the assessee. For possible tax evasion exceeding Rs25 lakhs. The IRS contacting you can be stressful.

Premium federal filing is 100 free with no upgrades for premium taxes. Whether the non-compliance is a mere omission. The tax authority levy heavy penalties on individuals who do not file Income tax return.

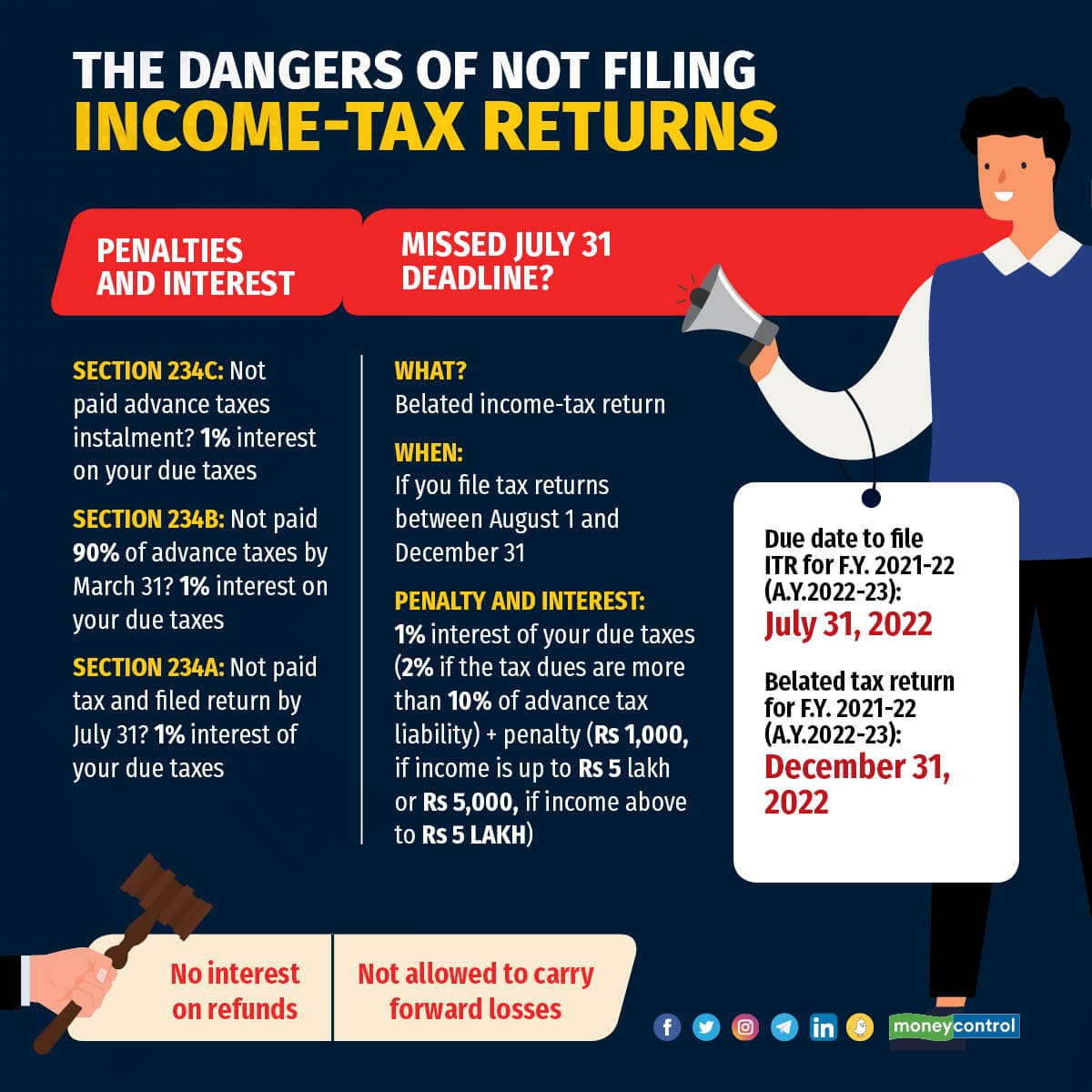

Applicable fines for delay in filing non-filing of Indian ITR. For the financial year 2019-20 the government in view of the pandemic extended the due date to file ITR to January 10 2021 for non-audit cases and February 15 2021 for audit. If you owe taxes and fail to pay them you.

Here they are. Due Date of Filing Income Tax Return for an NRI The due date of filing income tax return for the financial year 2012-13 is 31st July 2013. Other than the above-mentioned consequences a taxpayer can face some inconveniences in case of delay in filing a tax return.

If the firm or individual files the returns beyond the due date they must pay the penalty of 5000. Penalty provisions for non-filing of Indian ITR Transfer Pricing TP Report. Income up to 25 lakhs No tax.

Not filing your return on time can have negative consequences ranging from delaying your refund to civil and criminal penalties. Thus Non-Filing of the Income Tax Return may result in the Best Judgement Assessment. Tax holiday for three years.

C onsequences of non-filing of Income Tax Return. In this article Munmun Kadam of Rajiv Gandhi National University of law discusses Legal consequences of non-filing of Income tax return. If the taxpayers income is below five lacs the penalty fee is limited to.

Applicable fines for delay in filing non-filing of. If you missed the due date here are some consequences of not filing an income tax return that NRIs may face. The non-filing and the non-payment of tax returns are two of the most common violations committed by the taxpaying public.

We work with you and the IRS to settle issues. The slabs for residents are as follows. In order to give entrepreneurial ventures a much-needed boost the government in the union budget 2016-17 has announced to provide a deduction of 100 tax.

Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7 years. Ad Work with Jackson Hewitt to Find Solutions for Resolving Your Notice From the IRS. Income between 25 lakhs and 5 lakhs 5 tax.

First know what the due date for Income Tax Return filing is. AO can issue notice us 142 1 if the return is not filed before the time allowed us 139 1. This is an assessment carried out as per the best judgment of the Assessing.

Belated return under section 139 4 for the financial year 2021-22 can be filed at any time before the expiry of one year from the end of the relevant assessment year AY 2022. Consequences of not filing ITR in India for NRIs.

Non Filing Of Income Tax Return Corporate Genie

Filing Income Tax Returns 2020 Late Filing Of Income Tax Returns Check Late Fees Consequences

Penalty On Late Filing Of Income Tax Return Simple Tax India

Here S Why You Should Not Wait Till The Last Day To File Your Income Tax Return

Income Tax Return Deadline Tomorrow Consequences Of Missing It

Penalty For Late Filing Of Income Tax Return Fy21 22 Taxwinner

Penalty For Late Filing Of Income Tax Return

Income Tax Return Filing Implications For Delay Non Filing Of Itr For Individual Taxpayers The Financial Express

I T Return Filing Interest Penalties On The Cards If Failed To File Returns By July 31

How To Respond To Non Filing Of Income Tax Return Notice

Benefits Of Filing Itr Income Tax Return Advantages Explained

Income Tax Return Deadline Tomorrow Know About The Consequences Of Missing It

Missed Itr Deadline You Can Still File Income Tax Return For Fy 2021 22 But There S A Catch The Financial Express

Income Tax Returns Who Should File Them And When

Consequences Of Not Filing The Income Tax Return Form Itrf On Time Crowe Malaysia Plt

Consequences Of Not Filing Income Tax Return Youtube

What Are The Consequences Of Not Filing The Income Tax Return Income Tax News Judgments Act Analysis Tax Planning Advisory E Filing Of Returns Ca Students